Sitemize hoşgeldiniz.

Tarih: 10-24-2025

Saat: 11:15

Gönenbaba İnşaat Malzemeleri Sanayi ve Ticaret LTD. ŞTİ. Yerköy/YozgatGönenBaba Ticaret, Odun, Kömür, Demir, Çimento, Kireç, Tuğla, Kiremit, Galvanizli Tel, Beton Direk, Kum ve Çakıl satışlarımız başlamıştır. |

Üye Panelİ

Anket

Yükleniyor ...

Yükleniyor ...

KATEGORİLER

- ! Без рубрики

- 1

- 12play My 786

- 188bet 250 706

- 188bet App 605

- 188bet 우회 475

- 1win App 248

- 2

- 20 Bet 774

- 20 Bet App 125

- 20 Bet Casino 24

- 20 Bet Casino 900

- 20bet Apk 837

- 20bet Casino Review 499

- 20bet Login 255

- 20bet Promo Code 297

- 20bet Τηλεφωνο Επικοινωνιας 844

- 20bet 見るだけ 477

- 3

- 365

- 4

- 5

- 708

- 888 Online Casino 233

- 8x Bet 936

- 8xbet App 320

- 8xbet App 391

- 8xbet Casino 917

- 8xbet Tai 37

- a16z generative ai

- adobe generative ai 2

- Affiliate

- articles

- aug_sb

- BAHÇE MALZEMELERİ

- bahisyasal

- bahisyasal 8000

- beste-zahlungsarten.de

- Bet 188 Link 691

- Betriot Bonus 285

- Betriot Online 715

- Bizzo Casino Bonus 690

- Bizzo Casino Bonus Code 420

- Bizzo Casino Bonus Code 942

- Bizzo Casino It 845

- blog

- Bonus Bez Depozytu Ggbet 75

- Bookkeeping

- Buy Semaglutide

- Casino

- casinom 7290

- CH

- chatbot recruiting 10

- Chicken Road Demo 687

- CIB

- EC

- Excursions 362

- Fb777 Vip Login Registration 756

- Forex News

- Forex Trading

- Genel

- Gg Bet Casino 442

- Hell Spin 1 Deposit 480

- Hell Spin 742

- Hell Spin Promo Code 190

- Hellspin Casino 65

- Hellspin Casino No Deposit Bonus 459

- Hellspin Promo Code 236

- httpswww.comchay.de

- httpswww.hermannhirsch.com

- İNŞAAT MALZEMELERİ

- Kasyno Hell Spin 588

- Lemon Casino 100 Free Spins 211

- LinkM1

- Luckycola 207

- Luxury Casino Canada 240

- Monro-casino

- Mostbet Apk 514

- Mostbet Login 646

- Mostbet Ofitsialnii Sait 632

- NEW

- news

- Nv Casino Online Login 658

- oct

- oct_bh

- oct_hitech-advisor.com

- oct_mb

- oct_pb

- oct_troyandlindsey.com

- oct_weareautoworld.com

- oct1

- oct2

- oct3_AZ

- oct4

- Omegle

- Omegle cc

- Online Casino

- Our online casino partners

- Partners

- pdrc

- Post

- Queen 777 Login 612

- ready_text

- Rtbet Bonus 342

- Semaglutide Online

- sep_mars_innovationforum_hopscotchfriday

- sep+

- sep1

- sep2

- sep4

- showbet 8610

- Slottica 50 Free Spins No Deposit 890

- Slottica Bonus 436

- Slottica Cassino 748

- Slottica Login 655

- Sober living

- Spin Bizzo Casino 544

- Spin Palace Casino 42

- Spin Palace Casino 50

- Tadhana Slot Download 83

- test

- uncategorized

- What Is The Best Wallet For Crypto 919

- Zet Casino Bonus 856

- Новости Форекс

- Форекс Брокеры

- Форекс Обучение

POPÜler YAZILAR

- İLETİŞİM

(5,00 out of 5)

(5,00 out of 5) - TEL ÖRGÜ ÇEŞİTLERİ

(5,00 out of 5)

(5,00 out of 5) - HAKKIMIZDA

(5,00 out of 5)

(5,00 out of 5) - İNŞAAT MALZEMELERİ

(5,00 out of 5)

(5,00 out of 5) - RESİMLER

(5,00 out of 5)

(5,00 out of 5) - REFERANS

(5,00 out of 5)

(5,00 out of 5) - Galvanizli Tel

(5,00 out of 5)

(5,00 out of 5) - Kum ve Çakıl

(5,00 out of 5)

(5,00 out of 5) - Dikenli Tel

(5,00 out of 5)

(5,00 out of 5) - Beton Direk

(5,00 out of 5)

(5,00 out of 5)

SON YORUMLAR

Yazar: gonenbaba

Yazar: gonenbaba

Tarih: 16 Kasım 2021 / 16:17

Tarih: 16 Kasım 2021 / 16:17

Etiketler:

Etiketler:

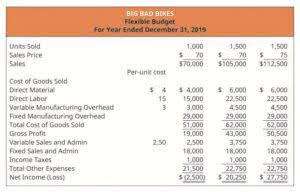

Therefore, all those accounts are included for which current balances must closing entries be used in the next financial reporting period and for which accounts cannot be closed out. A temporary account records balances for a single accounting period, whereas a permanent account stores balances over multiple periods. For instance, the year 2020 revenue and expense accounts would show the balances pertaining to just that year and not for 2019 or 2018. The statement of retained earnings shows the period-endingretained earnings after the closing entries have been posted. Whenyou compare the retained earnings ledger (T-account) to thestatement of retained earnings, the figures must match. It isimportant to understand retained earnings is not closed out, it is only updated.

How to Delete Closing Entries in QuickBooks: A Comprehensive Guide

- Temporary accounts, also known as nominal accounts, are accounts that track financial transactions and activities over a specific accounting period.

- By clearing these accounts, you ensure each new period starts fresh, giving you a clear picture of your business’s financial health.

- The purpose of the income summary is to show the net income (revenue less expenses) of the business in more detail before it becomes part of the retained earnings account balance.

- To close that, we debit Service Revenue for the full amount and credit Income Summary for the same.

- For example, the revenues account records the amount of revenues earned during an accounting period—not during the life of the company.

- Whether it’s a routine audit or a surprise check from the authorities, with accurate closing entries, you’ll have nothing to fear.

- If your business received payment for services not yet provided, you need to adjust the unearned revenue.

Temporary accounts include all revenue and expense accounts, and also withdrawal accounts of owner/s in the case of sole proprietorships and partnerships (dividends for corporations). The remaining balance in Retained Earnings is $4,565 the following Figure 5.6. This is the same figure found on the statement of retained earnings. Notice that the balances in interest revenue and service revenue are now zero and are ready to accumulate revenues in the next period. The Income Summary account has a credit balance of $10,240 (the revenue sum).

Impact on Corporations: Dividends, Retained Earnings, and Beyond

Additionally, many expenses that can be immediately deducted as an investor are on the closing statement; if you QuickBooks Accountant miss them you’ll be stuck with a higher tax bill than necessary. The accounts that remain in the accounting equation after closing are called permanent accounts. Assets, liabilities, common stock, and retained earnings are not closed at the end of the period because they are not used to measure activity for only one specific period. Only incomestatement accounts help us summarize income, so only incomestatement accounts should go into income summary. What is the current book value ofyour electronics, car, and furniture?

Closing the Income Summary Account

Prepare the closing entries for Frasker Corp. using the adjustedtrial balance provided. Printing Plus has a $4,665 credit balance in its Income Summaryaccount before closing, so it will debit Income Summary and creditRetained Earnings. If both summarizeyour income in the same period, then they must be equal. However, if the company also wanted to keep year-to-dateinformation from month to month, a separate set of records could bekept as the company progresses through the remaining months in theyear.

You’d never know exactly how your business performed over each period. Closing entries might seem like an extra step, but they’re crucial for keeping your financial records clean and accurate. At the end of the period, you move these balances into a holding account called income summary. In this guide, I’ll walk you through the ins and outs of closing entries, using real-world examples to illustrate the process.

What Are the Four Closing Entries?

In adjustable Trial Balance, we processed the transactions for Bold City Consulting and prepared the financial statements at the end of March. Notice that the balances in the expense accounts are now zeroand are ready to accumulate expenses in the next period. The IncomeSummary account has a new credit balance of $4,665, which is thedifference between revenues and expenses (Figure5.5).

Step 3: Clear the balance in the income summary account to retained earnings

When closing entries are made, the balances of temporary accounts, such as revenue, expense, and dividends accounts, are transferred to permanent accounts like retained earnings. This process ensures that the balance sheet reflects the cumulative results of the company’s financial activities over multiple accounting periods. By resetting temporary accounts to zero, closing entries also prepare these accounts to record transactions for the next accounting period, maintaining the integrity and accuracy of the financial statements. A closing entry is an accounting term that refers to journal entries made at the end of an accounting period to close temporary accounts.

Notice that the Income Summary account is now zero and is ready for use in the next period. The Retained Earnings account balance is currently a credit of $4,665. All accounts can be classified as either permanent (real) or temporary (nominal) the following Figure 1.27. BlackLine Journal Entry is assets = liabilities + equity a comprehensive solution that centralizes and automates the creation, validation, review, and posting of closing entries. It increases efficiency, reduces risk, optimizes capacity, and streamlines reviews and audits.

Oppss! Hiç yorum yapılmamış!

İlk yorumu neden sen yapmıyorsun?

İlk yorumu neden sen yapmıyorsun?